Contract

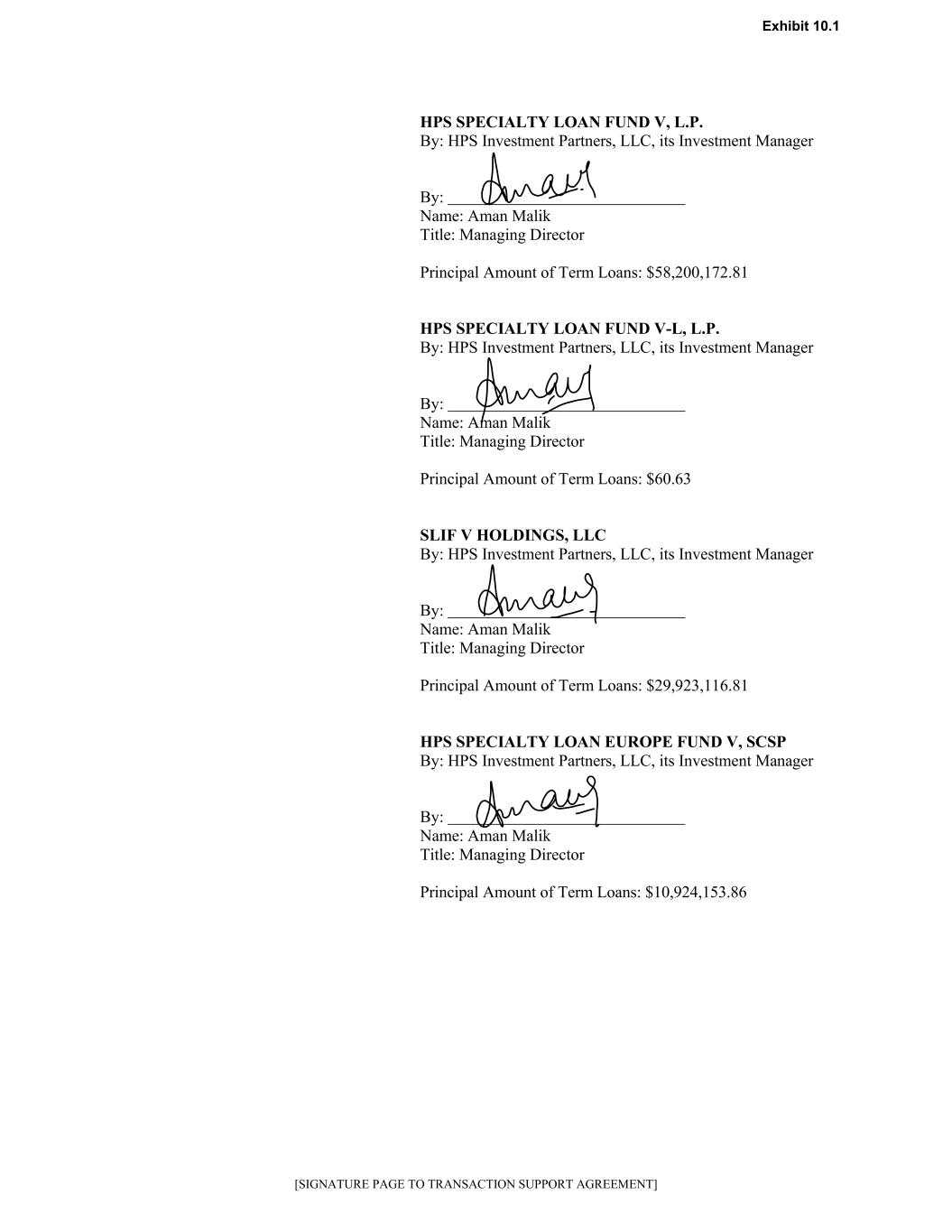

Execution Version WEIL:\99037057\16\18434.0011 THIS TRANSACTION SUPPORT AGREEMENT IS NOT AND SHALL NOT BE DEEMED AN OFFER OR ACCEPTANCE WITH RESPECT TO ANY SECURITIES. ANY SUCH OFFER OR SOLICITATION WILL COMPLY WITH ALL APPLICABLE SECURITIES LAWS. NOTHING CONTAINED IN THIS TRANSACTION SUPPORT AGREEMENT SHALL BE AN ADMISSION OF FACT OR LIABILITY OR, UNTIL THE OCCURRENCE OF THE SUPPORT EFFECTIVE DATE (AS DEFINED HEREIN), DEEMED BINDING ON ANY OF THE PARTIES TO THIS AGREEMENT ON THE TERMS DESCRIBED IN THIS AGREEMENT. TRANSACTION SUPPORT AGREEMENT This TRANSACTION SUPPORT AGREEMENT (together with all exhibits, schedules, and attachments hereto, as amended, supplemented, amended and restated, or otherwise modified from time to time in accordance with the terms hereof, this “Agreement”), dated as of March 15, 2023, is entered into by and among: (i) ATI Physical Therapy Inc. (“Topco”), ATI Holdings Acquisition, Inc. (the “Borrower”), Wilco Intermediate Holdings, Inc. (“Holdings”) and the Guarantors under the Credit Agreement (each, a “Company Party” and collectively, the “Company” or the “Company Parties”); (ii) Barclays Bank PLC (“Barclays”), as lender under the Credit Agreement; (iii) Barclays, as Administrative Agent under the Credit Agreement (pursuant to Section 28 hereof); (iv) HPS Investment Partners, LLC, as Lender Representative under the Credit Agreement and each HPS Lender under the Credit Agreement (“HPS” and together with Barclays, the “Consenting First Lien Lenders”); (v) Certain entities affiliated with or managed by, or affiliates of each of (a) Knighthead Capital Management, LLC, (b) Marathon Asset Management LP, (c) Onex Credit Management LLC and Onex Credit Partners, LLC, and (d) Caspian Capital L.P., as holders of 100% of the Preferred Stock and, to the extent specified on the signature pages hereto, as lenders under the Credit Agreement; and (vi) The undersigned investment entities affiliated with Advent International Corporation (“Advent” and together with the Consenting First Lien Lenders and the Consenting Preferred Equityholders, the “Consenting Stakeholders”), as holder of the majority of the Common Stock issued and outstanding as of the date hereof. Each Company Party and Consenting Stakeholder is referred to as a “Party” and collectively, the “Parties.” WHEREAS, the Parties have agreed to undertake the Transaction (as defined herein) on the terms and subject to the conditions set forth herein, including as set forth in the Transaction Exhibit 10.1

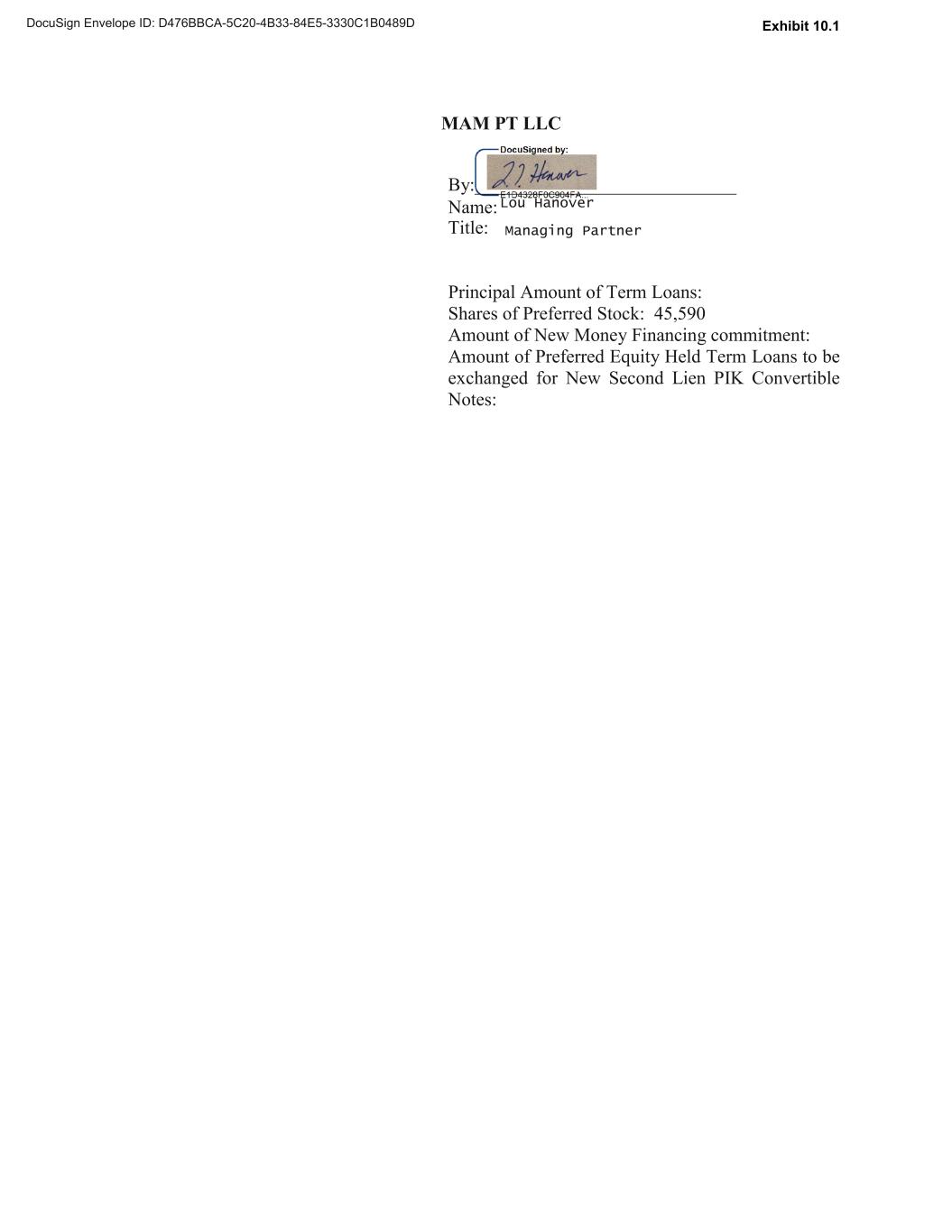

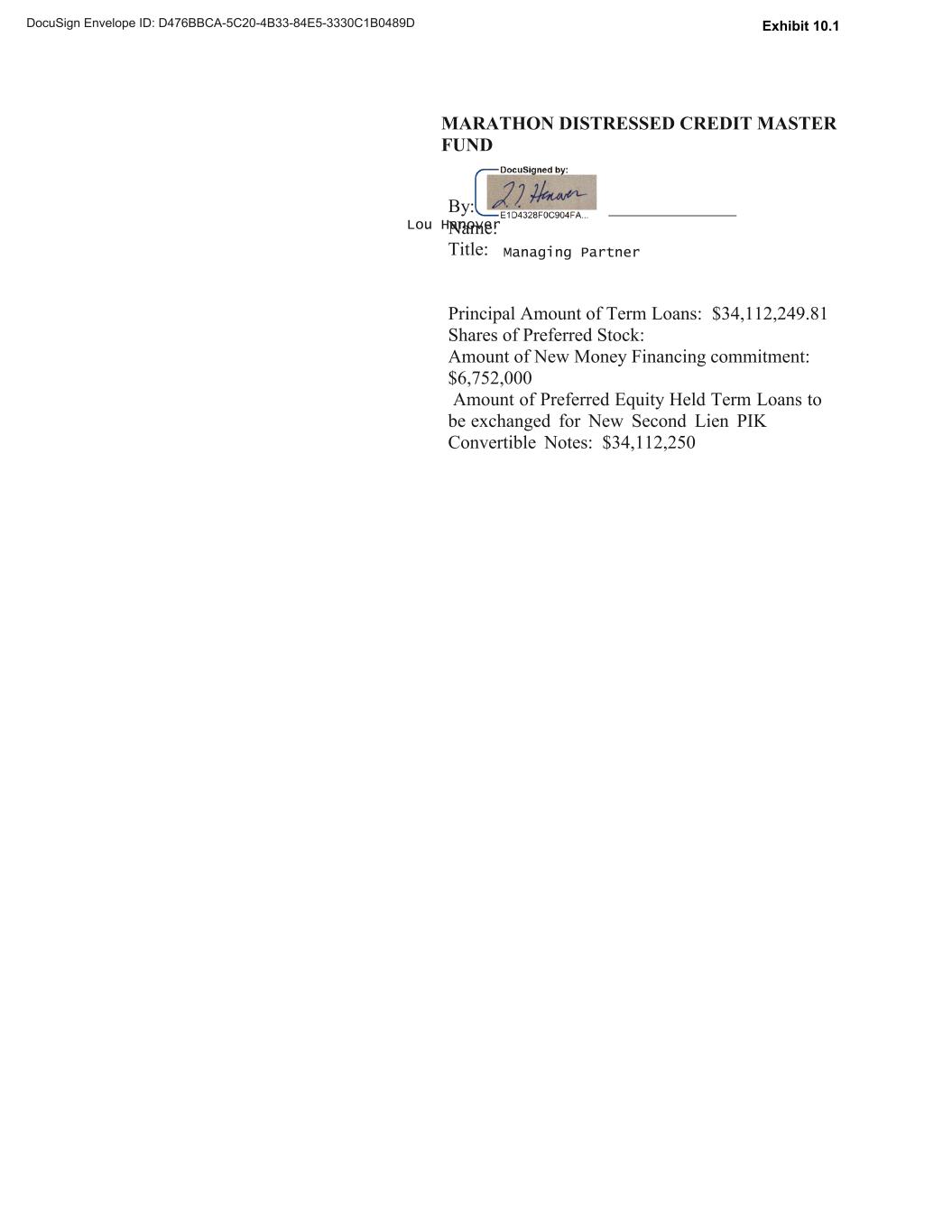

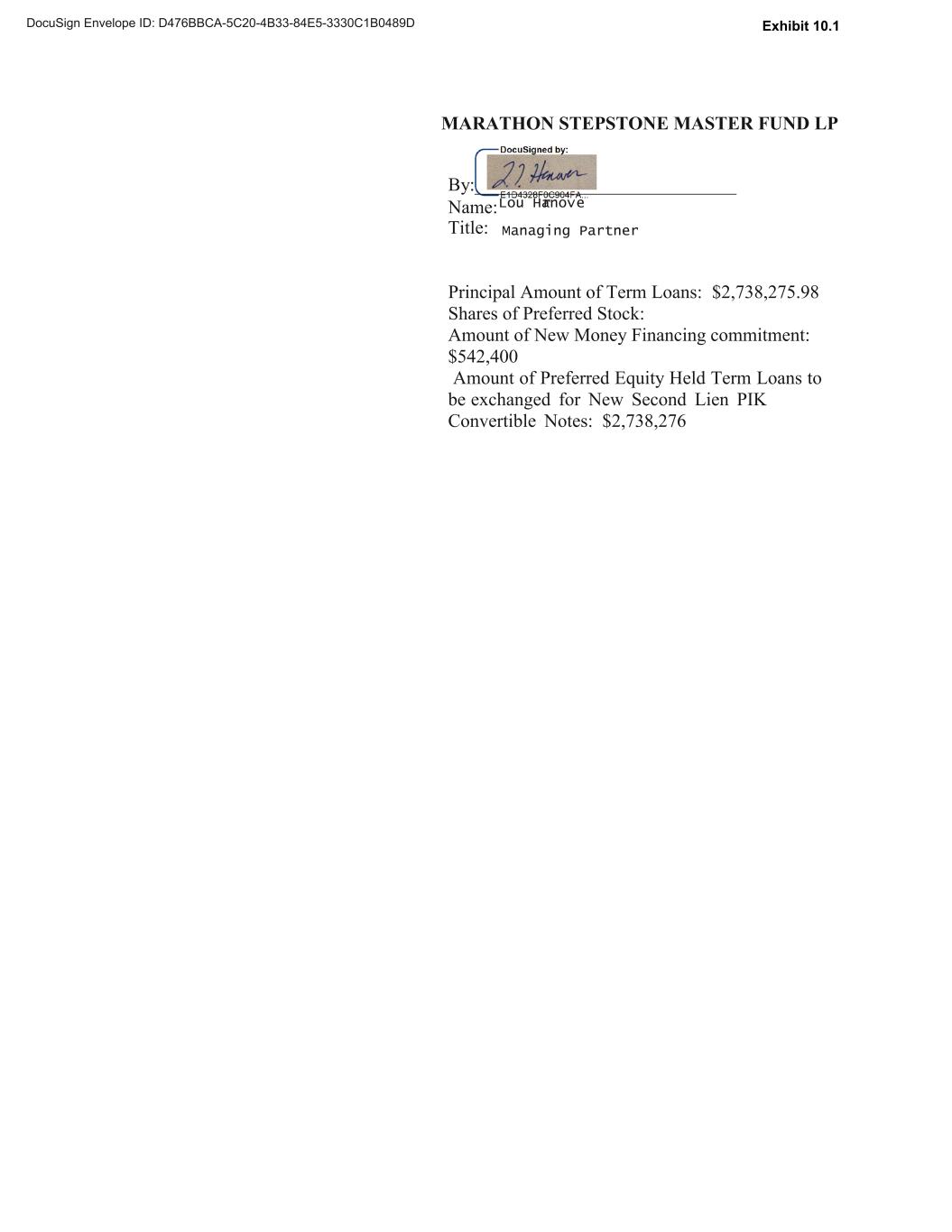

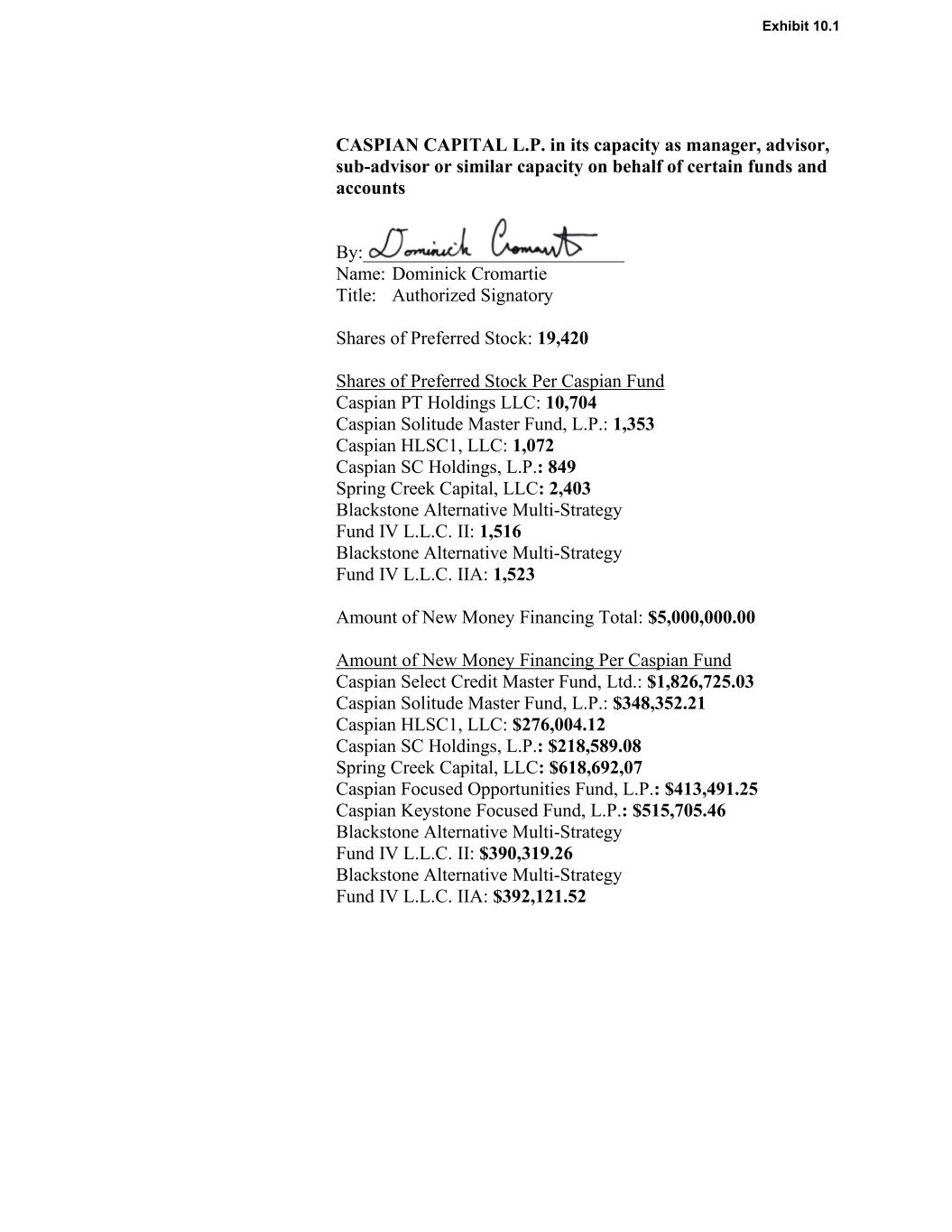

-2- WEIL:\99037057\16\18434.0011 Term Sheet (as defined herein), which is the product of arm’s-length, good faith discussions between the Parties and their respective advisors; WHEREAS, as of the date hereof, each Consenting First Lien Lender and Consenting Crossholder is the beneficial owner, or the investment advisor or manager for the beneficial owner(s), of Term Loans or Revolving Loans, as applicable, in the amount set forth on its signature page hereto; WHEREAS, as of the date hereof, each Consenting Preferred Equityholder is the beneficial owner, or the investment advisor or manager for the beneficial owner(s), of Preferred Stock in the amounts set forth on its signature page hereto; WHEREAS, as of the date hereof, HPS and the Consenting Crossholders collectively hold, directly or indirectly, 100% of the outstanding Term Loans; WHEREAS, as of the date hereof, the Consenting Preferred Equityholders collectively hold, directly or indirectly, 100% of the Preferred Stock; WHEREAS, as of the date hereof, Advent holds, directly or indirectly, in excess of 56% of the Common Stock issued and outstanding as of the date hereof; and WHEREAS, the Parties desire to express to each other their mutual support and commitment in respect of the matters addressed in this Agreement and in the transaction term sheet attached hereto as Exhibit A (together with all term sheets, schedules, exhibits, and annexes attached thereto, and as may be modified in accordance with the terms hereof, the “Transaction Term Sheet”). NOW, THEREFORE, in consideration of the premises and the mutual covenants and agreements set forth herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties, intending to be legally bound, agree as follows: 1. Certain Definitions. Capitalized terms used but not defined in this Agreement shall have the meanings ascribed to them in the Transaction Term Sheet. As used in this Agreement, the following terms have the following meanings: (a) “Administrative Agent” as defined in the definition of “Credit Agreement”. (b) “Agreement Among Lenders” has the meaning ascribed to the term “AAL” in the Credit Agreement. (c) “Alternative Transaction” means any plan, dissolution, winding up, liquidation, receivership, assignment for the benefit of creditors, workout, sale or disposition, reorganization, assignment for the benefit of creditors, merger, consolidation, tender offer, exchange offer, business combination, joint venture, partnership, sale of all or substantially all assets, debt Exhibit 10.1

-3- WEIL:\99037057\16\18434.0011 equitization, recapitalization, refinancing, material amendment, new money financing transaction or restructuring of any of the Company Parties or their assets other than the Transaction, as set forth in the Transaction Term Sheet. (d) “Assignment and Assumption Agreement” means the Master Assignment and Assumption Agreement, the terms and conditions of which are materially set forth in the Transaction Term Sheet. (e) “Certificate of Designation Amendment” means that certain Certificate of Amendment to Certificate of Designation of Series A Senior Preferred Stock of Topco, filed with the Delaware Secretary of State on or prior to the Closing Date. (f) “Claim” means, except as otherwise defined solely for the purposes of section 6 of this Agreement, any right to payment, whether or not such right is reduced to judgment, liquidated, unliquidated, fixed, contingent, matured, unmatured, disputed, undisputed, legal, equitable, secured, or unsecured. (g) “Closing Date” means the date on which the Transaction is consummated. (h) “Common Stock” means Topco’s issued and outstanding Class A common stock. (i) “Consenting Crossholder” means any party to this agreement which is both a lender under the Credit Agreement and a holder of Preferred Stock, in each case as indicated on the signature page or applicable Joinder Agreement for such party. (j) “Consenting Preferred Equityholder” means any party to this agreement which is a holder of Preferred Stock, as indicated on the signature page or applicable Joinder Agreement for such party. (k) “Consenting Preferred Equityholders’ Consent” means that certain Action by Written Consent of the Series A Senior Preferred Stockholders of the Company approving the Transaction and certain related matters. (l) “Credit Agreement” means that certain Credit Agreement, dated as of February 24, 2022, by and among the Borrower, Holdings, the lenders party thereto, Barclays, as Administrative Agent (together with its permitted successors and assigns in such capacity, the “Administrative Agent”), and HPS Investment Partners LLC, as Lender Representative, as amended by that certain Amendment No. 1 to Credit Agreement dated as of March 30, 2022. (m) “Credit Agreement Amendment” means Amendment No. 2 to the Credit Agreement, the material terms and conditions of which are set forth in the Transaction Term Sheet and Exhibit B to the Transaction Term Sheet. (n) “Default” has the meaning assigned to such term in the Credit Agreement. (o) “Definitive Documents” means the material agreements that are necessary to implement the Transaction, including, but not limited to: (a) the Credit Agreement Amendment, (b) the Assignment and Assumption Agreement, (c) any documents relating to the New Money Exhibit 10.1

-4- WEIL:\99037057\16\18434.0011 Financing, including, without limitation, the Second Lien Note Purchase Agreement, the Intercreditor Agreement, and the Registration Rights Agreement, (d) any documents relating to the Preferred Stock, including, without limitation, the Investors’ Rights Agreement Amendment, the Certificate of Designation Amendment, and the Consenting Preferred Equityholders’ Consent, (e) the Management Incentive Program, (f) any other documents related to the amendment and/or restatement of the Organizational Documents of the Company required to implement the Transaction, (g) an amendment to the Agreement Among Lenders and (h) such other related documents and ancillary agreements required to implement the Transaction. (p) “Event of Default” has the meaning assigned to such term in the Credit Agreement. (q) “Fees and Expenses” has the meaning set forth in Section 4(v). (r) “First Lien Loans” means the Term Loans and the Revolving Loans. (s) “First Lien Termination Event” means, solely with respect to the Consenting First Lien Lenders, any of the following: (i) if (a) any Default that is, in the good faith determination of the Company, incapable of being cured or (b) an Event of Default shall occur under the Credit Agreement; provided, that, clause (i) shall not apply to any Specified Default; or (ii) notice of the occurrence of a Consenting Stakeholder Termination Event by any other Consenting Stakeholder. (t) “Governmental Authority” means any federal, state, local or other governmental authority having jurisdiction over any of the Company Parties. (u) “Intercreditor Agreement” means the subordination and intercreditor agreement, to be entered as of the Closing Date, by and among the Administrative Agent on behalf of the holders of the First Lien Loans and an agent to be determined on behalf of the New Second Lien PIK Exchangeable Notes. (v) “Interest” means any capital stock, membership interest, partnership interest, or other equity security or rights exercisable or exchangeable into capital stock or any other equity security, whether vested or unvested, of a Company Party. (w) “Investors’ Rights Agreement” means that certain Investors’ Rights Agreement, dated February 24, 2022, by and among Topco and the Consenting Preferred Equityholders, among others. (x) “Investors’ Rights Agreement Amendment” means that certain First Amendment to the Investors’ Rights Agreement, to be entered as of the Closing Date, by and among Topco and the Consenting Preferred Equityholders party thereto. (y) “Joinder Agreement” means a joinder to this Agreement substantially in the form attached to this Agreement as Exhibit B providing, among other things, that such Person signatory thereto is bound by the terms of this Agreement. For the avoidance of doubt, any party that executes a Joinder Agreement shall be a “Consenting Stakeholder” and “Party” under this Agreement as provided therein. Exhibit 10.1

-5- WEIL:\99037057\16\18434.0011 (z) “Loan Documents” has the meaning assigned to such term in the Credit Agreement. (aa) “Majority Consenting Preferred Equityholders” means, at any time, Consenting Preferred Equityholders that collectively beneficially own or control more than at least 50% of all issued and outstanding Preferred Stock at such time. (bb) “Management Incentive Program” means that certain management incentive program to be adopted by ▇▇▇▇▇ as of the Closing Date on terms and conditions reasonably acceptable to each of the Consenting Stakeholders. (cc) “New Money Financing” has the meaning set forth in the Transaction Term Sheet. (dd) “New Second Lien PIK Exchangeable Notes” means the new second lien PIK exchangeable notes to be issued by the Borrower (or, upon the request of the Majority Consenting Preferred Equityholders, Topco) to the Consenting Preferred Equityholders, the material terms of which are set forth in the Transaction Term Sheet. (ee) “Organizational Documents” means (a) with respect to a corporation, the charter, articles or certificate of incorporation, as applicable, and bylaws thereof, (b) with respect to a limited liability company, the certificate of formation or organization, as applicable, and the operating or limited liability company agreement thereof, (c) with respect to a partnership, the certificate of formation and the partnership agreement, and (d) with respect to any other Person the organizational, constituent and/or governing documents and/or instruments of such Person. (ff) “Outside Closing Date” means June 15, 2023. (gg) “Outside Signing Date” means April 15, 2023. (hh) “Person” means any “person” as defined in section 101(41) of the Bankruptcy Code, including any individual, corporation, limited liability company, partnership, joint venture, association, joint-stock company, trust, unincorporated organization or government or any agency or political subdivision thereof or other entity. (ii) “Preferred Equity Held Term Loans” means the Term Loans held by the Consenting Crossholders or their respective affiliates. (jj) “Preferred Stock” means Topco’s issued and outstanding Series A Preferred Stock. (kk) “Registration Rights Agreement” means a registration rights agreement to be entered as of the Closing Date, by and among Topco and the Consenting Preferred Equityholders for the benefit of the holders of the New Second Lien PIK Exchangeable Notes and the shares of Common Stock into which such notes are exchangeable. (ll) “Revolving Credit Facility” means the “Revolving Facility” as defined in the Credit Agreement. Exhibit 10.1

-6- WEIL:\99037057\16\18434.0011 (mm) “Revolving Loans” has the meaning assigned to such term in the Credit Agreement. (nn) “Securities Act” means the Securities Act of 1933, as amended. (oo) “Special Committee” means those certain special committees of the boards of directors of Topco and ▇▇▇▇▇▇▇▇. (pp) “Specified Default” means any Default or Event of Default under Section 7.01(e) of the Credit Agreement prior to the Outside Closing Date arising from the Borrower’s failure to deliver an audit report for its fiscal year ended December 31, 2022 that satisfies the requirements set forth in Section 5.01(b) of the Credit Agreement. (qq) “Support Effective Date” means the date on which the counterpart signature pages to this Agreement have been executed and delivered by each of the Parties hereto. (rr) “Tax Code” means the Internal Revenue Code of 1986, as amended. (ss) “Term Loan Facility” means the “Term Facility” as defined in the Credit Agreement. (tt) “Term Loans” has the meaning assigned to such term in the Credit Agreement. (uu) “Transaction” means all acts, events, and transactions contemplated by, required for, and taken to implement the transactions contemplated under this Agreement (including the Transaction Term Sheet and, for the avoidance of doubt, all other term sheets, schedules, exhibits, and annexes attached thereto), pursuant to the Definitive Documents, each in the singular and collectively, as applicable. (vv) “TSA Support Period” means the period commencing on the Support Effective Date and ending on the earliest of (i) with respect to any Party, the date on which this Agreement is terminated in accordance with Section 8 hereof with respect to such Party, (ii) the Outside Closing Date, and (iii) the Closing Date. 2. Transaction Term Sheet; Definitive Documents. (a) Transaction Term Sheet. The Transaction Term Sheet (and all schedules, annexes, and exhibits thereof) is expressly incorporated herein by reference and made part of this Agreement as if fully set forth herein. The Transaction Term Sheet, including the schedules, annexes, and exhibits thereto, sets forth certain material terms and conditions of the Transaction. Notwithstanding anything else in this Agreement to the contrary, in the event of any inconsistency between this Agreement and the Transaction Term Sheet (including the attachments thereto, as applicable), the Transaction Term Sheet (including the attachments thereto, as applicable) shall control. (b) Definitive Documents. The Definitive Documents remain subject to negotiation and completion. Each of the Definitive Documents shall (i) contain terms and conditions consistent in all material respects with this Agreement, including, for the avoidance of doubt, the Exhibit 10.1

-7- WEIL:\99037057\16\18434.0011 Transaction Term Sheet, as amended, restated, amended and restated, supplemented or otherwise modified from time to time in accordance with Section 12 herein, and (ii) to the extent any matter is not addressed in the Transaction Term Sheet, shall be in form and substance reasonably acceptable to the Company and each of the Consenting Stakeholders party to the applicable Definitive Document; provided, that, any provision of any Definitive Document which has an adverse effect on HPS or the Revolving Lenders shall be in form and substance satisfactory to HPS or the Required Revolving Lenders, as applicable (such consent not to be unreasonably withheld). 3. Agreements of the Consenting Stakeholders; Acknowledgment of the Company Parties. (a) Agreement to Support. During the TSA Support Period, each of the Consenting Stakeholders agree, subject to the terms and conditions hereof (including, for the avoidance of doubt, the termination rights under Section 8), that each Consenting Stakeholder, severally and not jointly, shall use commercially reasonable efforts to: (i) support the Transaction, to act in good faith and to take any and all actions reasonably necessary to consummate the Transaction in a manner consistent with this Agreement, as promptly as practicable, and in no event later than the Outside Closing Date; (ii) not direct any Person to take any action inconsistent with the Consenting Stakeholder’s obligations under this Agreement, and, if such Person, at the direction of the Consenting Stakeholder in breach of this Agreement, takes any action inconsistent with the Consenting Stakeholder’s obligations under this Agreement, the Consenting Stakeholder shall direct and use commercially reasonable efforts to cause such Person to cease, withdraw, and refrain from taking any such action; (iii) negotiate in good faith the Definitive Documents and, to the extent applicable, execute the Definitive Documents; (iv) not directly or indirectly, through any Person, take any action, including initiating (or encouraging any other Person to initiate) any legal proceeding, that is inconsistent with or that would reasonably be expected to prevent, interfere with, delay, or impede the consummation of the Transaction; (v) to the extent any legal or structural impediment arises that would prevent, hinder, or delay the consummation of the Transaction, negotiate in good faith appropriate additional or alternative provisions to address any such impediment (to the extent not prohibited by law or regulation applicable to the Consenting Stakeholders); (vi) obtain and deliver such approvals, consents, waivers, and documents as are necessary to authorize the Consenting Stakeholders’ or the Company’s consummation and implementation of the Transaction in accordance with this Agreement, including the Transaction Term Sheet; (vii) support and take all actions reasonably necessary or reasonably requested by the Company to confirm such Consenting Stakeholder’s support for, and facilitate the Exhibit 10.1

-8- WEIL:\99037057\16\18434.0011 consummation of the Transaction (to the extent not prohibited by law or regulation applicable to the Consenting Stakeholders); and (viii) consent to the releases set forth in Section 6 hereof (it being understood that such releases shall not become effective until the Closing Date); provided, that, any obligation, other than with respect to the commitment obligations in connection with the New Money Financing, arising under this Section 3(a) shall not require any Consenting Stakeholder to, directly or indirectly, incur any non de minimis cost, expense, liability, or Claim. (b) Temporary Forbearance, Etc.. (i) Forbearance by the Consenting Preferred Equityholders and Advent. Each of the Consenting Preferred Equityholders and Advent shall temporarily forbear during the TSA Support Period from the exercise of any and all rights and remedies against any of the Company Parties in contravention of this Agreement or that would reasonably be expected to prevent, interfere with, delay, or impede the consummation of the Transaction, whether at law, in equity, by agreement or otherwise, which are or become available to them in respect of any Claims (as defined below) or Interests, as applicable, including, without limitation, any rights and all rights and remedies arising under or in connection with the Certificate of Designation or the Investors’ Rights Agreement, in each case to the maximum extent permitted by law. For the avoidance of doubt, the foregoing forbearance shall not be construed to impair the ability of the Consenting Stakeholders to take any remedial action, without requirement for any notice, demand, or presentment of any kind (except as required by the Credit Agreement and/or any other Loan Document), at any time after the TSA Support Period (unless the TSA Support Period is terminated solely as a result of the occurrence of the Closing Date). If the Transaction is not consummated or if this Agreement is terminated for any reason (other than termination solely as a result of the occurrence of the Closing Date), the Consenting Stakeholders fully reserve any and all of their rights. (ii) Forbearance by Consenting First Lien Lenders. (A) To induce the Consenting First Lien Lenders to execute this Agreement, each Company Party (for itself and on behalf of each of their respective subsidiaries) hereby acknowledges, stipulates, represents, warrants and agrees as follows: (1) No Default or Event of Default under the Credit Agreement and/or any other Loan Document has occurred and is continuing as of the date hereof; provided that no representation is made in this sentence with respect to the forbearance in respect of any Specified Default. Except as expressly set forth in this Section 3(b)(ii) with respect to any Specified Default, the agreements of the Consenting First Lien Lenders hereunder to forbear in the exercise of their respective rights, remedies, powers, privileges and defenses under the Loan Documents in respect of any Specified Default during the TSA Support Period do not in any manner whatsoever limit any right of any of the Consenting First Lien Exhibit 10.1

-9- WEIL:\99037057\16\18434.0011 Lenders to insist upon compliance with this Agreement or any Loan Document during the TSA Support Period. (2) Nothing has occurred that constitutes or otherwise can be construed or interpreted as a waiver of, or, except as expressly set forth in this Section 3(b)(ii) with respect to any Specified Default, otherwise to limit in any respect, any rights, remedies, powers, privileges and defenses that the Administrative Agent, the Consenting First Lien Lenders or any other lenders under the Credit Agreement have or may have arising as the result of any Default or Event of Default (including any Specified Default) that has occurred or that may occur under the Credit Agreement, the other Loan Documents or applicable law. Except as expressly set forth in this Section 3(b)(ii) with respect to any Specified Default, the Consenting First Lien Lenders’ actions in entering into this Agreement are without prejudice to the rights of any of the Administrative Agent, the Consenting First Lien Lenders or any other lenders under the Credit Agreement to pursue any and all remedies under the Loan Documents pursuant to applicable law or in equity available to it in its sole discretion upon the termination (whether upon expiration thereof, upon acceleration or otherwise) of the TSA Support Period. (3) All of the assets pledged, assigned, conveyed, mortgaged, hypothecated or transferred to the Administrative Agent pursuant to the Collateral Documents (as defined in the Credit Agreement) are (and shall continue to be) subject to valid and enforceable, subject to the Legal Reservations (as defined in the Credit Agreement), liens and security interests of the Administrative Agent, as collateral security for all of the Secured Obligations (as defined in the Credit Agreement), subject to no Liens other than Liens permitted by Section 6.02 of the Credit Agreement, and all of the Secured Obligations are secured by unavoidable, subject to the Legal Reservations, first-priority, subject to Liens permitted by Section 6.02 of the Credit Agreement, security interest in and liens on the Collateral, as described in the Collateral Documents. Each Company Party (for itself and for each of their respective subsidiaries) hereby reaffirms and ratifies its prior conveyance to the Administrative Agent of a continuing security interest in and lien on the Collateral (as defined in the Credit Agreement). There are no offsets, counterclaims or defenses (other than any defense arising from the permitted release of any Loan Party from its obligations under the Loan Documents in accordance with the express terms thereof) to any of the Secured Obligations, nor are there any bases for any arguments for avoidance, recharacterization, subordination or any other claim, cause of action or other challenge of any kind to the Secured Obligations or the security interests in and liens on the Collateral, as applicable, under the Bankruptcy Code or under any other applicable law or otherwise. (4) Except as expressly set forth herein in this Section 3(b)(ii) with respect to any Specified Default, the Company Parties understand and accept the temporary nature of the forbearance provided hereby and that the Consenting First Lien Lenders have given no assurances that they will extend such forbearance beyond the TSA Support Period or provide waivers under or amendments to the Exhibit 10.1

-10- WEIL:\99037057\16\18434.0011 Credit Agreement or any other Loan Document. For the avoidance of doubt, and except as expressly set forth in this Section 3(b)(ii) with respect to any Specified Default, the forbearance in this Section 3(b)(ii) shall not be construed to impair the ability of the Consenting First Lien Lenders to take any remedial action, without requirement for any notice, demand, or presentment of any kind, at any time during or after the TSA Support Period (other than any such notice, demand or presentment that is required by the terms of the Loan Documents). If this Agreement is terminated for any reason, the Consenting First Lien Lenders fully reserve any and all of their rights. (B) Subject to (1) the occurrence of the Support Effective Date and (2) the continuing effectiveness and enforceability of the Loan Documents in accordance with their terms, the Consenting First Lien Lenders and the Consenting Crossholders agree to forbear in the exercise of their respective rights, remedies, powers, privileges and defenses under the Credit Agreement and the other Loan Documents solely in respect of any Specified Default during the TSA Support Period; provided that, (I) without limiting the terms of this clause (B), each Company Party shall comply with all limitations, restrictions, covenants and prohibitions that would otherwise be effective or applicable under the Loan Documents, and (II) nothing herein shall be construed as a waiver by the Administrative Agent, any Consenting First Lien Lender or any other Lender of any Specified Default. (C) Upon the occurrence of a termination of this Agreement with respect to any of the Consenting First Lien Lenders, this Agreement shall automatically and without any further action or notice terminate and be of no force and effect with respect to the Consenting First Lien Lenders; it being expressly agreed that the effect of such termination will be to permit the Consenting First Lien Lenders to exercise, or cause the exercise of, any rights, remedies, powers, privileges and defenses available to any of them under the Credit Agreement, the other Loan Documents or applicable law, immediately, without any further notice, demand, passage of time, presentment, protest or forbearance of any kind (all of which each Company Party hereby waives), in each case, subject to the terms of the Credit Agreement and the other Loan Documents. Notwithstanding anything contained in this Section 3(b)(ii) to the contrary, nothing in this Section 3(b)(ii) shall supersede, limit, waive or otherwise impair and/or modify the terms of any Definitive Document. Notwithstanding anything to the contrary in this Agreement, it is understood and agreed for the avoidance of doubt that the provisions in this Agreement that reference any Specified Default shall not be deemed to constitute an acknowledgement, inference or admission by the Company that any Specified Default has occurred or will occur. (c) Preservation of Rights. Notwithstanding the foregoing, nothing in this Agreement, shall: (i) be construed to limit consent and approval rights provided in this Agreement, the Transaction Term Sheet, and the Definitive Documents; (ii) be construed to prohibit any Consenting Stakeholder from contesting whether any matter, fact, or thing is a breach of, or is inconsistent with, this Agreement; and (iii) constitute a waiver or amendment of any provision of any documents or agreements that give rise to a Consenting Stakeholder’s Claims or Interests, as applicable. Exhibit 10.1

-11- WEIL:\99037057\16\18434.0011 (d) New Money Financing Commitment. So long as this Agreement has not been terminated and remains in full force and effect, each of the Consenting Preferred Equityholders (i) hereby commits, severally and not jointly, to provide (including through their affiliated designee(s) or assignee(s)) to the Company on the Closing Date a portion of the New Money Financing in an amount equal to the amount of the New Money Financing commitment set forth below its name on the signature page hereto in the form of the New Second Lien PIK Exchangeable Notes on the terms and conditions set forth in the Transaction Term Sheet (or as otherwise reasonably acceptable to the Consenting Preferred Equityholders, HPS, Barclays and the Company) and subject to the satisfaction of any conditions precedent reasonably agreed among the Consenting Preferred Equityholders and the Company Parties, and (ii) shall instruct the applicable agent or other representative under the New Second Lien PIK Exchangeable Notes to enter into the Intercreditor Agreement on the Closing Date. (e) Treatment of Preferred Equity Held Term Loans. So long as this Agreement has not been terminated and remains in full force and effect, each Consenting Crossholder hereby agrees that on the Closing Date (i) the amount of Preferred Equity Held Term Loans held by such Consenting Crossholder that is set forth below its name on the signature page hereto, which amounts for all such Consenting Crossholders aggregate to $100,000,000, shall be exchanged for New Second Lien PIK Exchangeable Notes on the terms and conditions set forth in the Transaction Term Sheet (or as otherwise reasonably acceptable to the Consenting Crossholders, HPS, Barclays and the Company) and subject to the satisfaction of any conditions precedent reasonably agreed among the Consenting Crossholders and the Company Parties, and (ii) such Consenting Crossholders shall instruct the applicable agent or other representatives under the New Second Lien PIK Exchangeable Notes to enter into the Intercreditor Agreement on the Closing Date. The New Second Lien PIK Exchangeable Notes shall be issued by the Borrower, or, if requested by the Majority Consenting Preferred Equityholders, Topco. (f) Consent Under the Credit Agreement. So long as this Agreement has not been terminated and remains in full force and effect, and subject to (i) the consummation of the actions contemplated under Section 3(d) and 3(e) above and the other transactions contemplated by the Transaction Term Sheet and (ii) the terms and conditions of this Agreement and the Transaction Term Sheet, each Consenting First Lien Lender and each Consenting Crossholder hereby agrees that on the Closing Date it shall (i) consent to (A) the covenant relief and modifications to the (1) Minimum Liquidity Covenant (as defined in the Credit Agreement), (2) Maximum Secured Net Leverage Covenant (as defined in the Credit Agreement), (B) the waiver of the requirement of the Borrower under Section 5.01(b) of the Credit Agreement to deliver audited financials without a “going concern” explanatory paragraph or like statement for the Fiscal Years (as defined in the Credit Agreement) ending December 31, 2022, December 31, 2023 and December 31, 2024, in each case, as set forth in the Transaction Term Sheet and (C) the other amendments to the Credit Agreement set forth in the Transaction Term Sheet and Exhibit B to the Transaction Term Sheet and (ii) enter into the documentation and take such actions contemplated by the Transaction Term Sheet. In consideration for the foregoing consent to the Transaction, the Company Parties hereby acknowledge and agree that (A) from and after the date of the Definitive Documents and until the second consecutive date for which Consolidated Adjusted EBITDA of the Borrower and its Subsidiaries for a Test Period ending on the last day of a fiscal quarter ending after the Closing Date is greater than $50,000,000 and the Borrower shall have delivered a Compliance Certificate (as defined in the Credit Agreement) to the Administrative Agent showing such calculation in Exhibit 10.1

-12- WEIL:\99037057\16\18434.0011 reasonable detail, interest on all Term Loans and Revolving Loans shall be increased by 1.00% per annum, which increased amount shall be paid on each Interest Payment Date (as defined in the Credit Agreement) (i) with respect to the Term Loans, in kind, and (ii) with respect to the Revolving Loans, in cash, (B) the Prepayment Premium with respect to all Term Loans in Section 2.12(f) of the Credit Agreement shall be reset from the Closing Date, (C) the Credit Agreement Amendment shall include the modifications thereto set forth in the Transaction Term Sheet and Exhibit B to the Transaction Term Sheet and (D) the Company shall pay the Increased Revolving Loan Interest Rate set forth in the Transaction Term Sheet. (g) Advent Voting Agreement. During the TSA Support Period, (a) provided, that, the non-Advent Parties have complied with their obligations hereunder and that this Agreement shall not have been terminated by any non-Advent Party, and (b) subject in all respects to the negotiation and completion of the Definitive Documents reasonably acceptable to Advent and that are consistent in all material respects with the terms and subject to the conditions set forth herein and in the Transaction Term Sheet, Advent, in its capacity solely as a holder of the Common Stock, hereby agrees to vote (in person or by proxy) at any meeting of the stockholders of Topco (whether annual, special or otherwise, and whether or not adjourned or postponed) or consent (or cause to be voted or consented) to any action by any written consent or resolution (x) in favor of any matters required under applicable law or stock exchange regulation to give effect to the Transaction, which shall include (i) the Company’s entry into the Definitive Documents, (ii) the appointment of directors to the board of directors of Topco by the Consenting Preferred Equityholders, (iii) any amendment and/or restatement of the Organizational Documents of the Company Parties or any other actions related to the Company’s corporate governance that are reasonably necessary to consummate the Transaction and (iv) any other transaction or proposal approved and/or recommended by the Special Committee, boards of directors, or members (as applicable) of the Company Parties relating directly or indirectly to the Transaction, which is reasonably necessary and appropriate to consummate the Transaction and are otherwise materially consistent with the Transaction Term Sheet and this Agreement and are reasonably acceptable to Advent, and (y) not support any other proposals that could reasonably be expected to delay or impair the ability of the Company to enter into the Definitive Documents or give effect to the Transaction. 4. Agreements of the Company Parties. (a) Covenants. Each Company Party agrees that, for the duration of the TSA Support Period, such Company Party shall (and shall cause its subsidiaries to): (i) support and use commercially reasonable efforts to consummate and complete the Transaction and take any actions reasonably necessary to consummate the Transaction in a manner consistent with this Agreement, as promptly as practicable, and in no event later than the Outside Closing Date; (ii) if the Company Parties receive an unsolicited bona fide proposal or expression of interest in undertaking an Alternative Transaction the Company Parties shall, within 48 hours of the receipt of such expression of interest, notify the Consenting Stakeholders of the receipt thereof, with such notice to include the material terms thereof and thereafter comply with Section 4(a)(iii)(B); Exhibit 10.1

-13- WEIL:\99037057\16\18434.0011 (iii) not (A) solicit, initiate or encourage the submission of any proposal or offer from any Person relating to an Alternative Transaction or (B) participate in any discussions or negotiations regarding, furnish any information with respect to, assist or participate in, or facilitate in any other manner any effort or attempt by any Person to do or seek any of the foregoing, provided that, the foregoing shall not limit the Company’s rights under section 8(e)(ii) in connection with the Fiduciary Out; (iv) not, nor encourage any other person or entity to, take any action which would, or would reasonably be expected to, breach or be inconsistent with this Agreement or delay, impede, appeal, or take any other negative action, directly or indirectly, to interfere with the consummation or implementation of the Transaction and, if such person or entity takes any action inconsistent with any Company Party’s obligations under this Agreement, the Company Party shall direct and use commercially reasonable efforts to cause such person or entity to cease, withdraw, and refrain from taking any such action; (v) (a) (I) no less than three (3) business days after the Support Effective Date and (II) during the TSA Support Period promptly (and no later than within five (5) business days after request) pay or reimburse the reasonable and documented, fees and out-of-pocket expenses of (1) Milbank LLP, counsel to HPS, (2) ▇▇▇▇▇ ▇▇▇▇ & ▇▇▇▇▇▇▇▇ LLP, counsel to the Consenting Preferred Equityholders, (3) Ropes & Gray LLP, counsel to Advent, and (4) ▇▇▇▇▇▇ ▇▇▇▇▇▇ & ▇▇▇▇▇▇▇ LLP, counsel to Barclays and the Administrative Agent (collectively, the “Fees and Expenses”), and (b) upon the Closing Date, pay or reimburse any unpaid Fees and Expenses, in each case incurred pursuant to the representation of their respective client in connection with the negotiation, implementation, or closing of the Transaction and in each case by wire transfer to the applicable professional of immediately available funds; (vi) prepare such proxy statements, information statements or other disclosure documents with respect to solicitations of the Topco’s existing shareholders necessary or advisable to implement the Transaction, including providing any and all information reasonably required in connection therewith; (vii) to the extent any legal or structural impediment arises that would prevent, hinder, or delay the consummation of the Transaction, negotiate in good faith appropriate additional or alternative provisions to address any such impediment; (viii) consent to the releases set forth in Section 6 hereof; (ix) provide prompt written notice (in accordance with Section 22 hereof) to the Consenting First Lien Lenders, the Consenting Preferred Equityholders and Advent between the date hereof and the Closing Date of (A) receipt of any written notice from any Governmental Authority in connection with this Agreement or the Transaction; and (B) receipt of any written notice of any proceeding commenced, or, to the actual knowledge of the Company Parties, threatened against the Company Parties, that, if successful, would prevent or materially interfere with, delay, or impede the consummation of the Transaction; (x) without limiting the generality of the foregoing, except as expressly contemplated by this Agreement or otherwise in the ordinary course of business consistent with Exhibit 10.1

-14- WEIL:\99037057\16\18434.0011 past practice, each of the Company Parties shall not, without prior written consent of each of the Consenting Stakeholders, (A) amend its Organizational Documents, (B) combine or reclassify any shares of capital stock of the Topco or declare, set aside, or pay any dividend or other distribution in respect of the capital stock of the Company, or redeem, repurchase or otherwise acquire or offer to redeem, repurchase, or otherwise acquire any Company equity securities, (C) issue, deliver or sell, or authorize the issuance, delivery or sale of, any Company equity securities or amend any term of any Company equity security, except, for the avoidance of doubt, in connection with any grant under the Company’s 2021 Equity Incentive Plan (as amended, expanded or supplemented from time to time), or (D) enter into an agreement to do any of the foregoing; (xi) from and after the date of this Agreement and during the TSA Support Period, operate the business of the Company and its subsidiaries in a manner determined by the Company to be reasonable and prudent given the circumstances existing at the time; and (xii) not designate any subsidiaries as “Unrestricted Subsidiaries” under the Credit Agreement. 5. Conditions to Effectiveness of the Transaction. (a) Conditions to Closing. The closing of the Transaction and the obligations of the parties in connection therewith are subject to satisfaction of each of the following conditions: (i) (a) each Definitive Document and any other documentation necessary to consummate the Transaction (other than those documents permitted to be executed and delivered on a post-closing basis in accordance with the terms thereof) shall be in form and substance reasonably acceptable to, and have been executed and delivered by, each party thereto, provided, that, any provision of any Definitive Document which has an adverse effect on HPS or the Revolving Lenders shall be in form and substance satisfactory to HPS or the Required Revolving Lenders, as applicable, and (b) any conditions precedent related thereto shall have been satisfied or waived; (ii) this Agreement shall be in full force and effect; (iii) the conditions precedent to the Transaction Term Sheet and any Definitive Document shall have been satisfied or waived by the appropriate parties in accordance with their terms; (iv) the Company Parties shall have paid or reimbursed any and all reasonable and documented, fees and out-of-pocket expenses of (A) Milbank LLP, counsel to HPS, (B) ▇▇▇▇▇ ▇▇▇▇ & ▇▇▇▇▇▇▇▇ LLP, counsel to the Consenting Preferred Equityholders, (C) Ropes & Gray LLP, counsel to Advent, and (D) ▇▇▇▇▇▇ ▇▇▇▇▇▇ & ▇▇▇▇▇▇▇ LLP, counsel to Barclays and the Administrative Agent, in each case incurred pursuant to the representation of their respective client in connection with the negotiation, implementation, and closing of the Transaction; (v) approval by Topco stockholders of the Transaction and the other transactions contemplated by the Definitive Documents; and Exhibit 10.1

-15- WEIL:\99037057\16\18434.0011 (vi) the Fees and Expenses as of such date shall be paid by the Company by wire transfer or immediately available funds. In addition, solely with respect to Barclays, the closing of the Transaction and the obligations of Barclays connection therewith are subject to the condition that each party to the Agreement Among Lenders shall have executed an amendment to the Agreement Among Lenders if required or reasonably requested by Barclays in connection with the Credit Agreement Amendment (which condition may be waived by Barclays). 6. Releases. (a) In consideration of the agreements of the Company, HPS, the Consenting Preferred Equityholders, Advent and Barclays contained herein and in the Definitive Documents, and for other good and valuable consideration the receipt and sufficiency of which are hereby acknowledged, except with respect to the representations, warranties and/or covenants of the Company, HPS, the Consenting Preferred Equityholders, Advent and Barclays contained in the Definitive Documents and any other related transaction documents, (I) each Company Party, on behalf of itself and its successors, assigns, and other legal representatives (the “Company Releasing Parties”), hereby absolutely, unconditionally and irrevocably releases, remises and forever discharges HPS, Barclays, each Consenting Preferred Equityholder, and Advent, and, in each case, its successors and assigns, and its present and former shareholders, direct and indirect owners, partners, members, managers, consultants, affiliates, subsidiaries, divisions, predecessors, directors, officers, employees, agents, attorneys, accountants, investment bankers, consultants and other representatives, and all Persons acting by, through, under or in concert with any of them, and each solely in their capacity as such (the “Company Released Parties”), (II) HPS, on behalf of itself and its successors, assigns, and other legal representatives (the “HPS Releasing Parties”), hereby absolutely, unconditionally and irrevocably releases, remises and forever discharges each Company Party, Consenting Preferred Equityholders (solely in such equityholder’s capacity as a Consenting Preferred Equityholder), Barclays and Advent, and, in each case, its successors and assigns, and its present and former shareholders, direct and indirect owners, partners, members, managers, consultants, affiliates, subsidiaries, divisions, predecessors, directors, officers, employees, agents, attorneys, accountants, investment bankers, consultants and other representatives, and all Persons acting by, through, under or in concert with any of them, and each solely in their capacity as such (the “HPS Released Parties”), (III) each Consenting Preferred Equityholder, on behalf of itself and its successors, assigns, and other legal representatives (the “Consenting Preferred Equityholder Releasing Parties”), hereby absolutely, unconditionally and irrevocably releases, remises and forever discharges each Company Party, HPS, Barclays and Advent and, in each case, its successors and assigns, and its present and former shareholders, direct and indirect owners, partners, members, managers, consultants, affiliates, subsidiaries, divisions, predecessors, directors, officers, employees, agents, attorneys, accountants, investment bankers, consultants and other representatives, and all Persons acting by, through, under or in concert with any of them, and each solely in their capacity as such (the “Consenting Preferred Equityholder Released Parties”), (IV) Advent, on behalf of itself and its successors, assigns, and other legal representatives (the “Advent Releasing Parties”), hereby absolutely, unconditionally and irrevocably releases, remises and forever discharges each Company Party, HPS, Barclays and each Consenting Preferred Equity Holder, and, in each case, its successors and assigns, and its present and former shareholders, direct and indirect owners, partners, members, Exhibit 10.1

-16- WEIL:\99037057\16\18434.0011 managers, consultants, affiliates, subsidiaries, divisions, predecessors, directors, officers, employees, agents, attorneys, accountants, investment bankers, consultants and other representatives, and all Persons acting by, through, under or in concert with any of them, and each solely in their capacity as such (the “Advent Released Parties”), and (V) Barclays, on behalf of itself and its successors, assigns, and other legal representatives (together with the Company Releasing Parties, the HPS Releasing Parties, the Consenting Preferred Equityholder Releasing Parties and the Advent Releasing Parties, the “Releasing Parties”) (each of (I)-(V) in their capacities as such), hereby absolutely, unconditionally and irrevocably releases, remises and forever discharges each Company Party, HPS, each Consenting Preferred Equity Holder and Advent, and, in each case, its successors and assigns, and its present and former shareholders, direct and indirect owners, partners, members, managers, consultants, affiliates, subsidiaries, divisions, predecessors, directors, officers, employees, agents, attorneys, accountants, investment bankers, consultants and other representatives, and all Persons acting by, through, under or in concert with any of them, and each solely in their capacity as such (together with the Company Released Parties, the HPS Released Parties, the Consenting Preferred Equityholder Released Parties and the Advent Released Parties, each in their capacities as such, the “Released Parties”), in each case, of and from all demands, actions, causes of action, suits, covenants, contracts, controversies, agreements, promises, sums of money, accounts, bills, reckonings, damages and any and all other claims, counterclaims, defenses, recoupment, rights of setoff, demands and liabilities whatsoever (individually, a “Claim” and collectively, “Claims”) of every name and nature, known or unknown, contingent or mature, suspected or unsuspected, both at law and in equity which any Releasing Party may now or hereafter own, hold, have or claim to have against the applicable Released Parties (as specified in this section 6(a)) or any of them for or on account of, or in relation to, or in any way in connection with the Company, the Company’s subsidiaries, the Transaction, actions taken to consummate the Transaction or any of the transactions contemplated thereunder or related thereto, and entry into the Definitive Documents; provided, that, (i) the release set forth in this Section 6(a) shall not be effective unless the Closing Date shall have occurred and (ii) nothing in this Section 6(a) shall be construed to (x) release the Released Parties from any (1) gross negligence, willful misconduct, or actual fraud, in each case as determined by a final order of a court of competent jurisdiction where such order is not subject to appeal, (2) Claims that arise solely from or relate to acts or omissions occurring after the Closing Date, (3) liability arising from or in connection with any pending shareholder or derivative actions filed against the Company or any of its officers and directors or any pending SEC inquiry or demand for information, or (4) obligations under, or waive any right to enforce, the terms of the Definitive Documents; or (y) (1) impact any Parties’ rights, as applicable and if any, to enforce the terms of the Loan Documents, including, without limitation, the indemnification provisions set forth therein, (2) constitute a waiver of any default or Event of Default arising thereunder or limit in any respect, any rights, remedies, powers, privileges and defenses that the Administrative Agent, the Consenting First Lien Lenders or any other lenders under the Credit Agreement have or may have arising as the result of any Default or Event of Default that has occurred or that may occur under the Credit Agreement or the other Loan Documents or (3) waive or release any indemnification and other obligations that are expressly stated in the Credit Agreement or any other Loan Document as surviving that respective agreement’s termination which shall remain in full force and effect. (b) Each Releasing Party understands, acknowledges and agrees that the release set forth above may be pleaded as a full and complete defense and may be used as a basis for an Exhibit 10.1

-17- WEIL:\99037057\16\18434.0011 injunction against any action, suit or other proceeding which may be instituted, prosecuted or attempted in breach of the provisions of such release. Each Releasing Party agrees that no fact, event, circumstance, evidence or transaction which could now be asserted or which may hereafter be discovered shall affect in any manner the final, absolute and unconditional nature of the release set forth above. (c) In entering into this Agreement, each Releasing Party has consulted with, and has been represented by, legal counsel and expressly disclaims any reliance on any representations, acts or omissions by any of the Released Parties and hereby agrees and acknowledges that the validity and effectiveness of the release set forth above does not depend in any way on any such representations, acts and/or omissions or the accuracy, completeness or validity hereof. The release set forth herein shall survive the termination of this Agreement or the other agreements contemplated hereby. Each Releasing Party acknowledges and agrees that the release set forth above may not be changed, amended, waived, discharged or terminated orally. (d) For the avoidance of doubt and notwithstanding anything in this Agreement to the contrary, the releases set forth in this Section 6 shall survive the termination of this Agreement but shall become effective only upon the closing of the Transaction. (e) References to Barclays in this Section 6 shall be a collective reference to Barclays Bank PLC in its capacity as Administrative Agent and Revolving Lender. 7. Transfer of Claims, Interests and Securities. (a) Except as otherwise provided in the Transaction Term Sheet, during the TSA Support Period, the Consenting Stakeholders agree, subject to the terms and conditions hereof, that each Consenting Stakeholder, severally and not jointly, shall not sell, transfer, loan, issue, participate, pledge, hypothecate, assign or otherwise dispose of or offer or contract to pledge, encumber, assign, sell or otherwise transfer (each, a “Transfer”), directly or indirectly, in whole or in part, any of its Claims against or Interests in the Company or any option thereon or any right or interest therein, unless such Transfer is made to a Person that is or becomes party to this Agreement or is otherwise approved by the Company. Notwithstanding the foregoing, (i) the Consenting Stakeholders shall be permitted during the TSA Support Period to Transfer their Claims and Interests, as applicable, to their respective affiliates and managed funds and accounts without the consent of any other party, provided that any such affiliate or managed fund or accounts agrees to be bound by the terms of this Agreement; and (ii) the foregoing restriction shall not be applicable to transferees that are broker-dealers or trading desks in their capacity or to the extent of their holdings as a broker-dealer or market maker of claims engaged in market making or riskless back-to-back trades. (b) Notwithstanding anything to the contrary herein, except as otherwise provided in the Transaction Term Sheet, each of the Consenting Preferred Equityholders and Advent, severally and not jointly, agrees that such Consenting Preferred Equityholder or Advent shall not, during the TSA Support Period, Transfer, or contract to Transfer, in whole or in part, directly or indirectly, any portion of its right, title, or interests in any of its shares, stock, or other equity interests in Topco, to the extent such action would impair any of the U.S. income tax attributes of Topco, Borrower, Holdings or any of their subsidiaries including, for the avoidance of doubt, under section Exhibit 10.1

-18- WEIL:\99037057\16\18434.0011 382 of the Tax Code (or analogous provisions of state income tax law); provided, however, that, (1) with respect solely to this Section 7(b), upon receipt of written notice of any proposed Transfer or contract to Transfer of shares, stock or other equity interests in TopCo, the Company shall (x) evaluate in good faith such proposed Transfer or contract to Transfer and, within 15 business days of the receipt of such notice, advise the proposing party as to whether such Transfer would result in an “ownership change” under Section 382 of the Internal Revenue Code (and to the extent applicable, U.S. Department of Treasury Regulations Section 1.1502-92) when viewed in the aggregate with any other proposed Transfers and (2) if the Company does not, within 15 business days, advise such proposing party that such proposed Transfer would be expected to result in such an “ownership change”, such Transfer shall not be prohibited by this Section 7(b). 8. Termination of Agreement. (a) This Agreement shall terminate as to all Parties or, if such termination arises under Section 8(e)(i) and (iv), the applicable Party, upon the receipt of written notice to such Parties, delivered in accordance with Section 22 hereof, from the Company Parties at any time after and during the continuance of any Company Termination Event. (b) This Agreement shall terminate with respect to a Consenting Stakeholder upon delivery to the other Parties of written notice, delivered in accordance with Section 22 hereof, from such Consenting Stakeholder at any time after and during the continuance of a Consenting Stakeholder Termination Event; provided, this Agreement shall remain in effect with respect to each other non-terminating Consenting Stakeholder unless and until such other Consenting Stakeholder separately terminates this Agreement as to itself pursuant to this Section 8(b). (c) This Agreement shall terminate with respect to each of HPS and Barclays upon delivery to the other Parties of written notice, delivered in accordance with Section 22 hereof, from HPS or Barclays, as applicable, at any time after and during the continuance of a First Lien Termination Event. (d) Notwithstanding any provision to the contrary in this Section 8, (A) except with respect to a Consenting Stakeholder Termination Event occurring under clause (ix) of the definition thereof, no Party may terminate this Agreement on account of a Company Termination Event or Consenting Stakeholder Termination Event, as applicable, caused by such Party’s failure to perform or comply in all material respects with the terms and conditions of this Agreement or where such Party is otherwise in breach of this Agreement (in each case unless such failure to perform, failure to comply, or breach arises from another Party’s breach of this Agreement that would otherwise be a Company Termination Event or Consenting Stakeholder Termination Event, as applicable) and (B) solely with respect to the Consenting First Lien Lenders, if (i) any Default that is, in the good faith determination of the Company, incapable of being cured or (ii) an Event of Default shall occur under the Credit Agreement, a Consenting First Lien Lender may terminate this Agreement on account of a Consenting Stakeholder Termination Event. (e) A “Company Termination Event” shall mean any of the following: (i) with respect to the applicable Consenting Stakeholder only, the breach in any material respect by any of the Consenting Stakeholders of any of the undertakings, Exhibit 10.1

-19- WEIL:\99037057\16\18434.0011 representations, warranties, or covenants set forth herein in any material respect that remains uncured for a period of five (5) business days after the receipt of written notice of such breach pursuant to Section 22 hereof (as applicable); (ii) the Special Committee, boards of directors, or members (as applicable) of the Company Parties reasonably determines in good faith based upon the advice of outside counsel that continued performance under this Agreement or pursuit of the Transaction would be inconsistent with the exercise of its fiduciary duties under applicable law; provided, however, that in the event a Company Party desires to terminate this Agreement pursuant to this Section 8(e)(ii) (such right to terminate this Agreement pursuant to this Section 8(e)(ii), the “Fiduciary Out”), the Company Party shall as soon as reasonably practicable but in no event less than one (1) day advance written notice to the Consenting First Lien Lenders, the Consenting Preferred Equityholders and Advent prior to the date such Company Party elects to terminate this Agreement pursuant to the Fiduciary Out advising the Consenting First Lien Lenders, the Consenting Preferred Equityholders and Advent that such Company Party intends to terminate this Agreement pursuant to the Fiduciary Out; (iii) the issuance by any Governmental Authority, including any regulatory authority or court of competent jurisdiction, of any ruling, judgment or order declaring this Agreement to be unenforceable, enjoining the consummation of a material portion of the Transaction or rendering illegal this Agreement or the Transaction, where such ruling, judgment or order has not been not stayed, reversed or vacated within twenty-five (25) calendar days after such issuance and where the Company has used commercially reasonable efforts to cause such ruling to be stayed, reversed, or vacated; (iv) if any Consenting Stakeholder (A) publicly announces their intention not to support the Transaction or (B) validly terminates this Agreement as to themselves pursuant to Section 8(b), in which case the Company can terminate as to such Consenting Stakeholder; (v) if the Definitive Documents shall not have been executed by the requisite parties by the Outside Signing Date; or (vi) if the Transaction shall not have been consummated by the Outside Closing Date. Notwithstanding the foregoing, any of the dates or deadlines set forth in this Section 8 may be extended in writing by agreement of the Company, the Consenting First Lien Lenders, the Consenting Preferred Equityholders and Advent (email being sufficient), provided, for the avoidance of doubt, that the Outside Signing Date and Outside Closing Date shall only be extended in accordance with the terms of section 12 of this Agreement. (f) A “Consenting Stakeholder Termination Event” shall mean any of the following: (i) the material breach by any Company Party or another Consenting Stakeholder of (A) any covenant contained in this Agreement or (B) any other obligations of the Company Parties set forth in this Agreement, and, in each case, such breach remains uncured for Exhibit 10.1

-20- WEIL:\99037057\16\18434.0011 a period of five (5) business days after receipt of written notice thereof pursuant to Section 22 hereof (as applicable); (ii) the representations or warranties made by the Company will have been untrue in any material respect when made; (iii) the representations or warranties made by any Consenting Stakeholder will have been untrue in any material respect when made; (iv) the Definitive Documents and any amendments, modifications, or supplements thereto include terms that are materially inconsistent with the Transaction Term Sheet and are not otherwise reasonably acceptable to the Consenting Stakeholders who have consent rights over the applicable Definitive Document in accordance with Section 2(b) hereof, and such event remains unremedied for a period of five (5) business days following the Company Parties’ receipt of notice pursuant to Section 22 hereof (as applicable); (v) the issuance by any Governmental Authority, including any regulatory authority or court of competent jurisdiction, of any ruling, judgment or order declaring this Agreement to be unenforceable, enjoining the consummation of the Transaction or rendering illegal this Agreement or the Transaction, and either (A) such ruling, judgment or order has been issued at the request of or with the acquiescence of a Company Party, or (B) in all other circumstances, such ruling, judgment or order has not been not stayed, reversed or vacated within twenty-five (25) calendar days after such issuance; (vi) if any Company Party (A) proposes, supports or agrees in writing to pursue (including, for the avoidance of doubt, as may be evidenced by a duly executed term sheet, letter of intent, or similar document) an Alternative Transaction, or (B) validly terminates this Agreement as to themselves pursuant to Section 8(b); (vii) [reserved]; (viii) if the Definitive Documents shall not have been executed by the requisite parties by the Outside Signing Date; (ix) if the Transaction shall not have been consummated on or before the Outside Closing Date; (x) solely with respect to the Consenting First Lien Lenders, a First Lien Termination Event; (xi) with respect to any Consenting Stakeholder other than the Consenting First Lien Lenders, obligations under the Credit Agreement shall have been accelerated and/or one or more lenders shall have exercised remedies thereof; or (xii) with respect to Advent, this Agreement is terminated by (i) any of the Consenting First Lien Lenders or (ii) Consenting Preferred Equityholders that collectively beneficially own or control more than 50% of all issued and outstanding Preferred Stock as of the date of such termination. Exhibit 10.1

-21- WEIL:\99037057\16\18434.0011 (g) Mutual Termination. This Agreement may be terminated by mutual agreement of each Party upon the receipt of written notice delivered in accordance with Section 22 hereof. (h) Automatic Termination. This Agreement shall terminate automatically, without any further action required by any Party, upon: (i) the filing or commencement of any proceeding relating to any of the Company Parties under any bankruptcy, reorganization, arrangement, insolvency, readjustment of debt, dissolution or liquidation law of any jurisdiction, the appointment of or taking possession by a custodian, receiver, liquidator, assignee, trustee, sequestrator or similar official of any of the Company Parties or of any substantial part of their property; (ii) the appointment of or taking possession by a custodian, receiver, liquidator, assignee, trustee, sequestrator or similar official of any of the Company Parties or of any substantial part of their property; (iii) the making by any of the Company Parties of an assignment for the benefit of creditors or the admission by any of the Company Parties in writing of its inability to pay its debts generally as they become due; and (iv) the occurrence of the Closing Date. For the avoidance of doubt, the termination events outlined in this Section 8 shall not survive the Closing Date. (i) Effect of Termination. Upon the termination of this Agreement as to a Party in accordance with this Section 8, if the Transaction has not been consummated, and except as provided in Section 16 hereof, this Agreement shall forthwith become void and of no further force or effect as to such Party and such Party shall, except as provided otherwise in this Agreement, be immediately released from its liabilities, forbearances, obligations, commitments, undertakings and agreements under or related to this Agreement and shall have all the rights and remedies that it would have had and shall be entitled to take all actions, whether with respect to the Transaction or otherwise, that it would have been entitled to take had it not entered into this Agreement, including all rights and remedies available to it under applicable law and any applicable agreements (including, for the avoidance of doubt, the Loan Documents); provided, however, that, in no event shall any such termination relieve a Party from liability for its breach or non- performance of its obligations hereunder prior to the date of such termination. (j) If the Transaction has not been consummated prior to the date of termination of this Agreement, nothing herein shall be construed as a waiver by any Party of any or all of such Party’s rights and the Parties expressly reserve any and all of their respective rights. Pursuant to Federal Rule of Evidence 408 and any other applicable rules of evidence, this Agreement and all negotiations relating hereto shall not be admissible into evidence in any proceeding other than a proceeding to enforce its terms. Exhibit 10.1

-22- WEIL:\99037057\16\18434.0011 9. Definitive Documents; Good Faith Cooperation; Further Assurances. Subject to the terms and conditions described herein, during the TSA Support Period, each Company Party, severally and jointly, and each Consenting Stakeholder, severally but not jointly, hereby covenants and agrees to reasonably cooperate with the other Parties in good faith in connection with, and shall exercise commercially reasonable efforts with respect to the pursuit, approval, implementation, and consummation of the Transaction pursuant to the Transaction Term Sheet, as well as the negotiation, drafting, execution (to the extent such Party is a party thereto), and delivery of the Definitive Documents. Furthermore, subject to the terms and conditions hereof, during the TSA Support Period each Consenting Stakeholder, severally but not jointly, shall each use reasonable efforts to take such action as may be reasonably necessary or reasonably requested by the other Parties to carry out the purposes and intent of this Agreement, including the making and filing of any required regulatory filings, and shall each refrain from taking any action that would frustrate the purpose and intent of this Agreement; provided, that, (x) any obligation, other than with respect to the commitment obligations in connection with the New Money Financing, arising under this Section 9 shall not require any Consenting Stakeholder to, directly or indirectly, incur any non de minimis cost, expense, liability, or Claim and (y) for the avoidance of doubt, and notwithstanding anything herein or the Transaction Term Sheet to the contrary, in no instance shall any Definitive Document cause, require, or in any way permit any Company Party or any of their affiliates to amend, modify, impair, or in any way alter any indemnification or contribution agreement, undertaking, or obligation in favor of any Advent Released Party currently in place as of the date hereof. 10. Representations and Warranties. (a) Each Consenting Stakeholder, severally and not jointly, and each Company Party, severally and jointly, represent and warrant to the other Parties that the following statements are true, correct and complete as of the date hereof: (i) such Party is validly existing and in good standing under the laws of its jurisdiction of incorporation or organization, and has all requisite corporate, partnership, limited liability company or similar authority to enter into this Agreement and carry out the transactions contemplated hereby and perform its obligations contemplated hereunder, and the execution and delivery of this Agreement and the performance of such Party’s obligations hereunder have been duly authorized by all necessary corporate, limited liability company, partnership or other similar action on its part; (ii) the execution, delivery and performance by such Party of this Agreement does not and will not (A) violate any material provision of law, rule or regulation applicable to it or, as applicable, any of its subsidiaries or its charter or bylaws (or other similar governing documents) or those of any of its subsidiaries or (B) conflict with, result in a breach of or constitute (with due notice or lapse of time or both) a default under any material contractual obligation to which it or, as applicable, any of its subsidiaries is a party, other than any default contemplated by the Transaction; Exhibit 10.1

-23- WEIL:\99037057\16\18434.0011 (iii) the execution, delivery and performance by such Party of this Agreement does not and will not require any registration or filing with, consent or approval of, or notice to, or other action, with or by, any federal, state or Governmental Authority or regulatory body; (iv) this Agreement is the legally valid and binding obligation of such Party, enforceable against it in accordance with its terms, except as enforcement may be limited by bankruptcy, insolvency, reorganization, moratorium or other similar laws relating to or limiting creditors’ rights generally or by equitable principles relating to enforceability; (v) such Party (A) is a sophisticated party with respect to the subject matter of this Agreement and the transactions contemplated hereby, (B) has adequate information concerning the matters that are the subject of this Agreement and the transactions contemplated hereby, (C) has such knowledge and experience in financial and business matters of this type that it is capable of evaluating the merits and risks of entering into this Agreement and of making an informed investment decision, and has independently and without reliance upon any warranty or representation by, or information from, any other Party or any officer, employee, agent or representative thereof, of any sort, oral or written, except the warranties and representations expressly set forth in this Agreement, and based on such information as such Party has deemed appropriate, made its own analysis and decision to enter into this Agreement and the transaction contemplated hereby, and (D) acknowledges that it has entered into this Agreement voluntarily and of its own choice and not under coercion or duress; (vi) with respect to the Company, such Party is not aware of the occurrence of any event, fact or circumstance that, due to any fiduciary or similar duty to any other Person, would prevent it from taking any action required of it under this Agreement; and (vii) such Party is not currently engaged in any discussions, negotiations or other arrangements with respect to any Alternative Transaction. (b) Each Consenting First Lien Lender, severally and not jointly, represents and warrants to the other Parties that such Consenting First Lien Lender is the beneficial owner of the aggregate principal amount of Term Loans or Revolving Loans, as applicable, set forth below its name on the signature page hereto, free and clear of any restrictions on transfer, liens, or options, warrants, purchase rights, contracts, commitments, claims, demands, and other encumbrances and does not own any other First Lien Loans, and/or (B) has sole investment and/or voting discretion and/or authority to vote on and provide consent or waivers with respect to such Term Loans or Revolving Loans. (c) Each Consenting Preferred Equityholder, severally and not jointly, represents and warrants to the other Parties that, as of the date hereof, each Consenting Preferred Equityholder (i) is the owner of the number of shares of Preferred Stock set forth below its name on the signature page hereto, free and clear of any restrictions on transfer, liens or options, warrants, purchase rights, contracts, commitments, claims, demands, and other encumbrances and does not own any other existing equity interests and (ii) has (A) sole investment or voting discretion with respect thereto, and (B) full power and authority to vote on and consent to matters concerning such equity interests or to exchange, assign, and transfer such equity interests. Exhibit 10.1

-24- WEIL:\99037057\16\18434.0011 (d) Advent, severally and not jointly, represents and warrants to the other Parties that, as of the date hereof, Advent (i) is the owner of the number of shares of Common Stock set forth below its name on the signature page hereto, free and clear of any restrictions on transfer, liens or options, warrants, purchase rights, contracts, commitments, claims, demands, and other encumbrances and does not own any other existing equity interests and (ii) has (A) sole investment or voting discretion with respect thereto, and (B) full power and authority to vote on and consent to matters concerning such equity interests or to exchange, assign, and transfer such equity interests. (e) Each Consenting Stakeholder represents and warrants to the other Parties that it (i) is an accredited investor (as such term is defined in Rule 501(a) of Regulation D promulgated under the Securities Act), (ii) understands that any securities to be acquired by it (if any) pursuant to the Transaction have not been registered under the Securities Act and that such securities are being offered and sold pursuant to the exemption from registration pursuant to Regulation D promulgated under the Securities Act, based in part upon such Consenting Stakeholder’s representations, as applicable, contained in this Agreement and cannot be sold unless subsequently registered under the Securities Act or an exemption from registration is available, (iii) has such knowledge and experience in financial and business matters that such Consenting Stakeholder is capable of evaluating the merits and risks of the securities to be acquired by it (if any) pursuant to the Transaction and understands and is able to bear any economic risks with such investment, (iv) is acquiring any securities to be acquired by it (if any) pursuant to the Transaction for its own account, for investment purposes only and not with a view to any distribution thereof that would not otherwise comply with the Securities Act and (v) did not decide to acquire any securities to be acquired by it (if any) pursuant to the Transaction as a result of any general solicitation or general advertising within the meaning of Rule 502 of Regulation D promulgated under the Securities Act. (f) Each Consenting Crossholder, severally and not jointly, represents and warrants to the other Parties that such Consenting Crossholder is the beneficial owner of the aggregate principal amount of Term Loans set forth below its name on the signature page hereto, free and clear of any restrictions on transfer, liens, or options, warrants, purchase rights, contracts, commitments, claims, demands, and other encumbrances and does not own any other Term Loans, and/or has sole investment and/or voting discretion and/or authority to vote on and provide consent or waivers with respect to such Term Loans. 11. Disclosure; Publicity. The Company Parties shall submit drafts to counsel to the Consenting Stakeholders, respectively, of any press release or other public statements that constitute disclosure of the existence or terms of this Agreement or any amendment to the terms of this Agreement or otherwise announcing the Transaction or relating to the Transaction at least two (2) business days prior to disclosure, or if such submission two business days prior to disclosure is not possible, as soon as reasonably practicable prior to disclosure. Except as required by applicable law, subpoena, or other legal process or regulation, and notwithstanding any provision of any other agreement between the Company and any Consenting Stakeholder to the contrary (other than in the Credit Agreement), no Party or its advisors shall disclose to any person (including, for the avoidance of doubt, any other Consenting Stakeholder), other than advisors to the Company, the principal amount or percentage of any debt or equity holdings of any Consenting Stakeholder without such Exhibit 10.1